Search has changed forever. Instead of the familiar ten blue links, users increasingly see AI-generated summaries at the top of results pages.

Whether it’s Google AI Overviews, ChatGPT Search, Bing Copilot, Gemini, Claude, or Perplexity, the journey starts, and often ends inside those AI answers.

💡 For SaaS growth teams, this creates a critical blind spot. If your brand isn’t cited or mentioned inside these AI-generated responses, you’re effectively invisible, no matter how strong your organic rankings used to be.

That invisibility impacts real business outcomes, fewer demo requests, fewer trials, and slower ARR growth.

Traditional SEO tools weren’t built for this world. They measure SERP rankings but can’t tell you whether Perplexity cited your blog post or if Google’s AI Overview recommended your product.

It’s time to evolve your content engine for answer-first discovery.

In this post, we’ll break down what brand visibility in AI search actually means, why it matters, and the best tools to measure and optimize it.

Table of Contents

What Is an AI Search Visibility Tool (AI Search Tracker)?

An AI search visibility tool (or AI search tracker) shows how often and how prominently your brand appears inside AI-generated answers, not just in traditional SERPs.

Instead of only telling you “You rank #3 for best PLG analytics tool,” an AI search tracker shows:

- Whether AI answers appear (Google AI Overviews, ChatGPT Search, Perplexity, Bing Copilot, etc.)

- If your brand is mentioned in those answers

- Whether your site is cited as a source

- How that visibility changes over time for each query set

In other words: it’s analytics for how answer engines describe and cite your brand.

📋 Get Listed / Advertise

We update this guide monthly. Want your tool featured? Contact: info@therankmasters.com.

The Best AI Visibility Tools in the Market

Here are the top platforms to consider, with simple “best for” labels so you can match based on your needs.

⚠️ This guide compares 11 focused platforms for AI-era discovery. Start here if you want a quick overview before diving into the deeper sections.

Key Takeaways: AI Search Visibility Tools at a Glance

Use this overview to spot the right tool (and budget) before diving into the full breakdowns.

Prices are indicative as of 2025 — always confirm on the vendor’s site.

- Surfer AI Tracker – Multi-Engine Coverage

AI Overviews + ChatGPT + Perplexity plus classic SEO in one dashboard.

Pricing: from $79/month - GrowByData – Deep Perplexity Tracking

Focused Perplexity visibility and citations for technical / dev-tool SaaS.

Pricing: quote-based (custom) - Profound AI Visibility – Agency & Enterprise

Tracks AI mentions/citations across engines with polished multi-brand reports.

Pricing: from $99/month - Rankability – Competitive Benchmarking

Compares your AI share-of-voice vs competitors on key queries.

Pricing: $124–$374/month - Waikay – Hallucination & Brand Facts

Monitors what AI “knows” about your brand and flags wrong or outdated facts.

Pricing: from $19.95/month - Advanced Web Ranking (AWR) – AIO + Classic SEO

Puts AI Overviews and traditional rankings in one flexible reporting setup.

Pricing: from $49/month - SISTRIX – Global AIO Presence

Strong for international AI Overview visibility across multiple markets.

Pricing: from 119 €/month - SE Ranking – Source-Level AIO Insights

Shows which specific pages fuel AI answers, tightly integrated with its SEO toolkit.

Pricing: from $119/month - seoClarity – Enterprise Suite

Enterprise SEO platform with integrated AI Overview & Perplexity tracking.

Pricing: custom, based on keyword volume - Nozzle – Data & BI Friendly

API-first SERP + AI visibility data for analysts and BI dashboards.

Pricing: $49–$59/month (entry tiers) - Visibility.ai – Startup-Friendly Tracker

Lightweight AI visibility tracking without enterprise complexity or cost.

Pricing: from $99/month

Here are the top AI visibility platforms of 2025 with their pricing details.

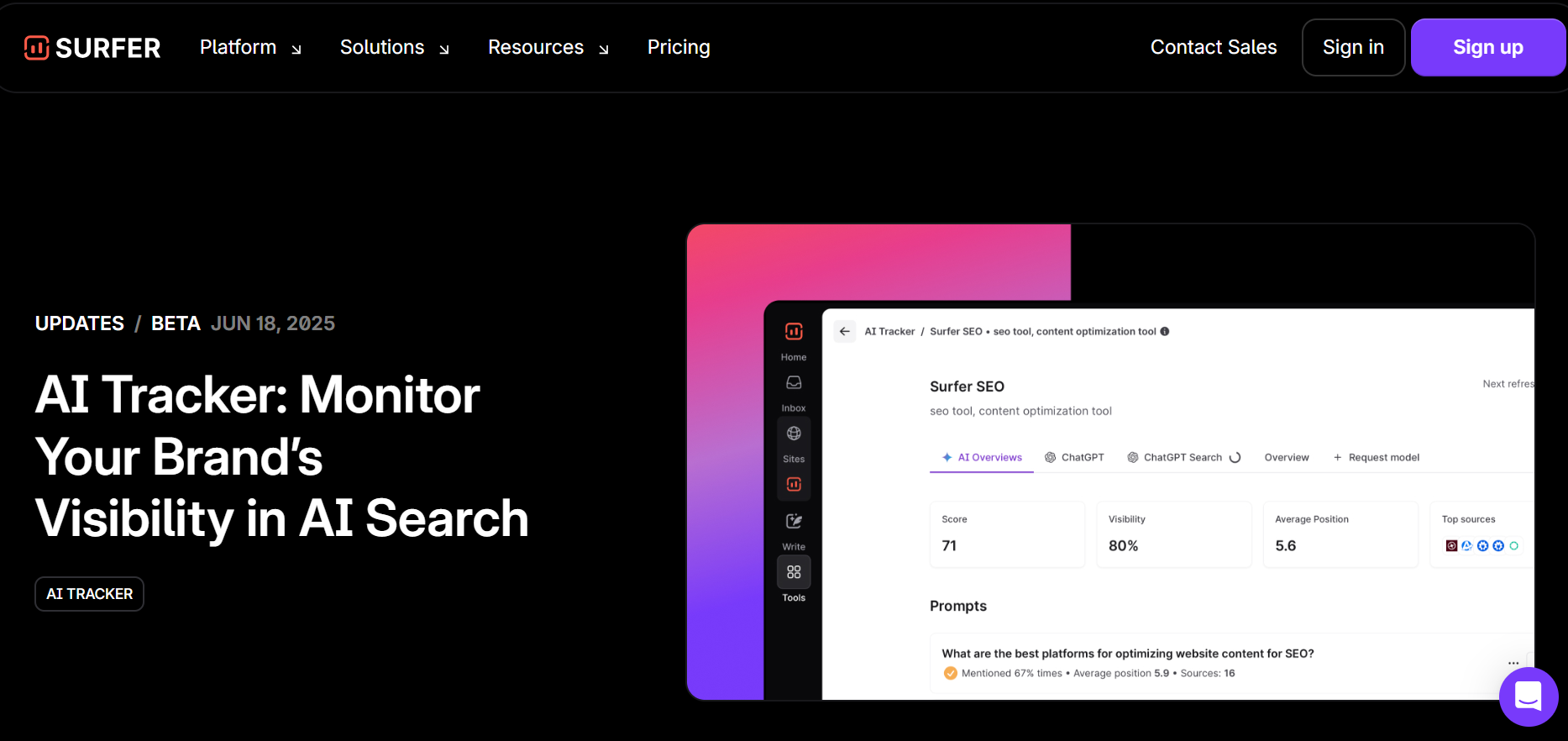

1. Surfer AI Tracker – Best for Multi-Engine Coverage

What it does: Surfer AI Tracker has quickly become a go-to for SaaS teams that need visibility across multiple AI engines in one dashboard. Unlike many point solutions that focus only on Perplexity, Surfer covers Google AI Overviews, Bing Copilot, and ChatGPT Search.

Why SaaS teams use it: For growth-stage SaaS, this is a huge advantage, you don’t have to stitch together insights from different tools. Surfer centralizes visibility so you can monitor whether your brand is consistently cited across the platforms your ICP uses at different stages of discovery.

Pair this with AI-powered content auditing tools to quickly surface pages that are losing citations and need fixes.

Free tier? No

▶️ Its strengths are the breadth of coverage and a clean, intuitive interface that in-house teams can get value from within a week.

The trade-off is pricing (it’s on the higher end). For teams where AI search is becoming a board-level conversation, the cost is justified, but early-stage startups might find it heavy.

Key Capabilities

- Tracks brand mentions and citations across AI Overviews, ChatGPT, Perplexity and more.

- Maps AI answer visibility back to specific keywords, pages, and topics.

- Compares AI visibility vs classic SEO rankings in one place.

- Surfaces content gaps and opportunities where AI answers appear but you’re not cited.

- Exports shareable dashboards and reports for stakeholders and clients.

Pricing snapshot

- Scale plan with AI Tracker: ~$175/month (billed annually, includes 5 prompts).

- Extra prompts: add-on blocks from $95/month (25 prompts) up to $495/month (300 prompts).

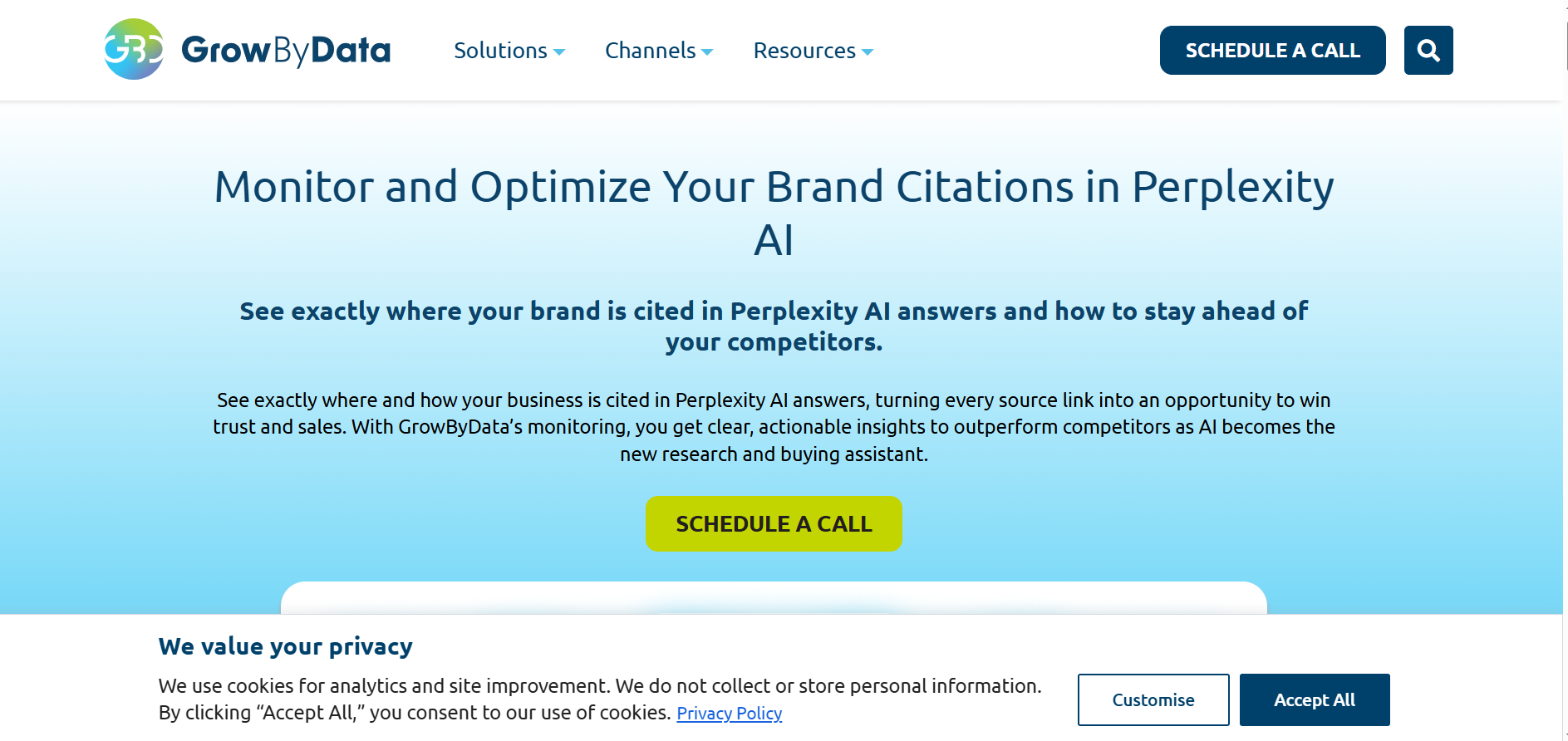

2. GrowByData’s Perplexity Monitor – Best for Deep Perplexity Tracking

What it does: If your ICP spends time on Perplexity for research and competitive benchmarking, GrowByData’s Perplexity Monitor is purpose-built for you.

It doesn’t just tell you if your brand is present, it logs citations over time, giving you a timeline of how consistently your content gets surfaced.

Why SaaS teams use it: This matters for SaaS products in developer tools, data infrastructure, or knowledge-heavy verticals where buyers rely on Perplexity to compare solutions.

You’ll know if product guides, blog posts, or case studies are consistently powering answers, or if you’re losing share-of-voice to a competitor.

If you spot a slide, activate a SaaS content pruning strategy to tighten topical relevance and reclaim citations.

Free tier? No

▶️ The strength here is depth: it’s one of the few tools that gives a granular view into Perplexity citations.

The limitation? Coverage is narrow (don’t expect Google AI Overview insights). For multi-platform AI visibility, pair GrowByData with a broader tool like Surfer.

Key Capabilities

- Monitors when and how often your brand appears in Perplexity answers.

- Breaks down which URLs and domains Perplexity is citing for each query.

- Shows trends over time so you can see gains/losses in Perplexity visibility.

- Highlights competitor share-of-voice inside Perplexity results.

- Provides enterprise-friendly reporting and APIs for data teams.

Pricing snapshot

- Positioned for mid-market to enterprise.

- Custom / quote-based pricing, no fixed public tiers.

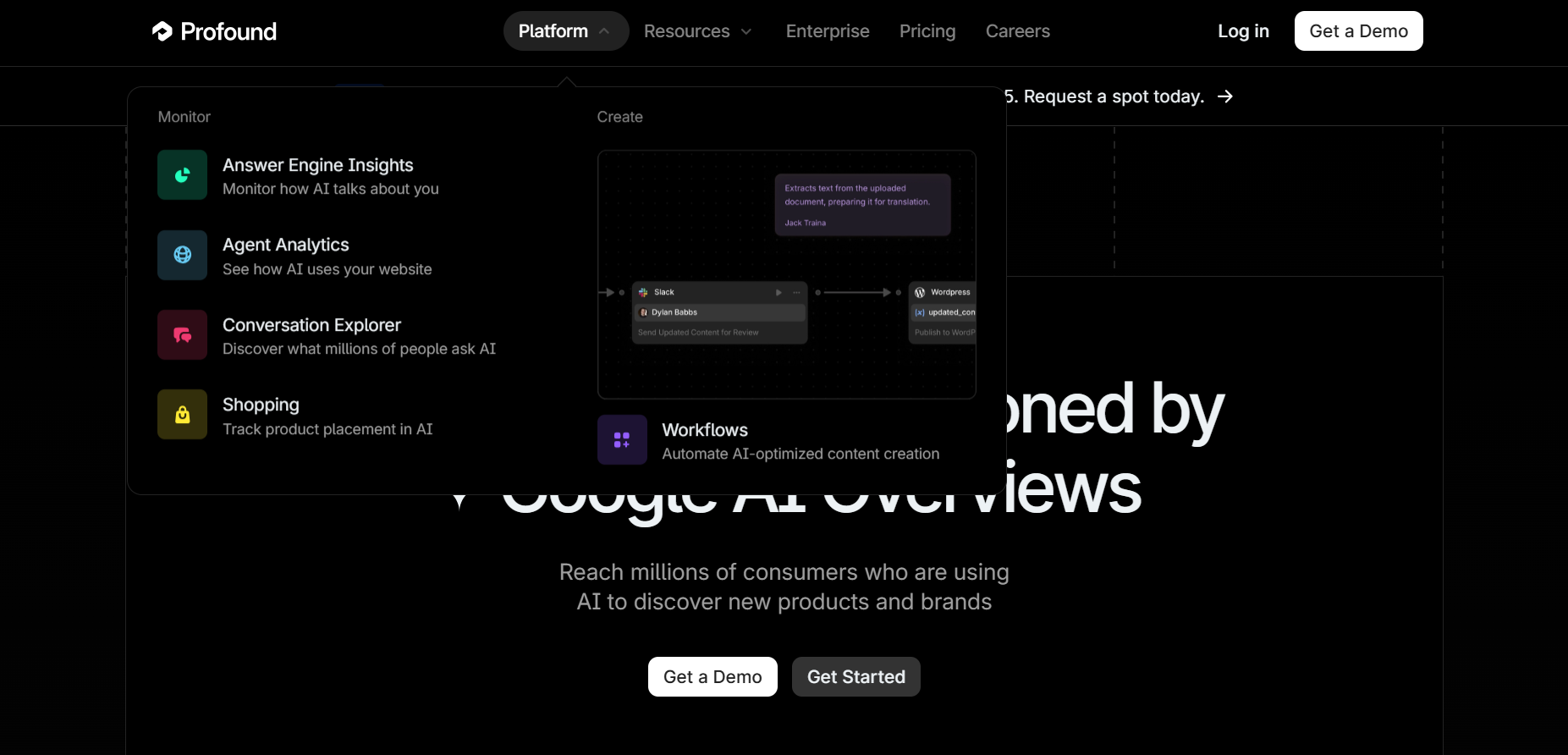

3. Profound AI Visibility – Best for Agencies and Enterprise Reporting

What it does: Profound is built for scale. If you’re an agency serving multiple SaaS clients or an in-house team managing several product lines, Profound gives you multi-client dashboards, white-label exports, and automated reporting.

Why SaaS teams use it: This makes it strong for VP-level marketers who need to present visibility metrics to execs or boards. Instead of hacking together screenshots, Profound creates clean, client-ready reports showing visibility shifts over time.

Free tier? No

If you also need to translate those visibility wins into pipeline, plug in product-led content CRO services to connect insights to conversion experiments and sign-up flows.

Downside: setup and pricing. It takes more effort to onboard and comes at a premium, worth it if you need executive-ready reporting and recurring roll-ups.

Key Capabilities

- Tracks brand mentions and citations across major AI answer engines.

- Supports multi-brand / multi-client visibility reporting in a single workspace.

- Builds executive-ready dashboards and PDF/slide exports.

- Segments AI visibility by country, category, product line or campaign.

- Integrates with existing SEO / analytics stacks for richer attribution.

Pricing snapshot

- Profound runs on custom enterprise pricing, with industry benchmarks and comparison tables putting entry-level plans at around $399/month and up.

4. Rankability’s Perplexity Tracker – Best for Competitive Benchmarking

What it does: Rankability’s Perplexity Tracker is for marketers who want to see exactly how they stack up against competitors inside Perplexity’s answers.

It focuses heavily on share-of-voice benchmarking, showing side-by-side comparisons across defined keyword sets.

Why SaaS teams use it: Use Rankability when stakeholders keep asking, “Why are they always mentioned and we’re not?” It’s built for head-to-head comparisons, making it easy to prove gaps, justify content/PR budgets, and measure whether your fixes actually move SOV.

For example, if your ICP searches “best PLG analytics tools” on Perplexity and you’re absent while your top rival dominates citations, that’s a clear gap in your visibility strategy.

Free tier? No

▶️ The strength of Rankability is competitive intelligence, you’ll always know whether you’re gaining or losing ground.

The trade-off is its narrow scope: like GrowByData, it’s Perplexity-first. If your growth strategy demands multi-engine coverage, you’ll need to layer Rankability with a broader tracker.

Key Capabilities

- Measures share-of-voice vs named competitors in AI answers.

- Shows which queries you win, lose, or share in Perplexity and other engines.

- Links AI visibility to specific landing pages, articles, and docs.

- Flags new entrants and competitive surges on critical “best tools” queries.

- Provides simple, client-facing reports for agencies and consulting partners.

Pricing snapshot

- Entry AI Analyzer tiers: ~$124–$149/month.

- Higher plans: $374/month, depending on volume/features.

5. Waikay – Best for Tracking AI Hallucinations About Your Brand

What it does: Waikay takes a unique angle!

Instead of only measuring AI mentions, it focuses on what AI systems believe about your brand.

Its Brand Fact Tracker and entity heatmaps show where large models have accurate knowledge versus where they hallucinate—or worse, confuse you with competitors.

Why SaaS teams use it: This makes it especially valuable for teams protecting reputation and ensuring AI-generated answers reflect the right facts.

You can spot gaps early, then feed corrective inputs into your SEO or PR workflows.

Free tier? Yes

▶️ The big strength is AI hallucination monitoring—turning vague risks into concrete, trackable insights.

The trade-off?

Waikay is newer, with less long-term visibility data than established SEO platforms, so some metrics may need cautious interpretation.

Key Capabilities

- Extracts the “facts” AI systems state about your brand (pricing, features, HQ, etc.).

- Flags incorrect, outdated, or risky claims across multiple LLMs.

- Groups findings by entity or topic so teams can prioritize fixes.

- Tracks how brand perception changes over time as you ship content/PR.

- Exports issue lists and summaries for product, legal, and comms teams.

Pricing snapshot

- Small team: ~$69.95–$20/month.

- Large teams: ~$199.95/month.

- Bigger projects: ~$444/month.

6. Advanced Web Ranking (AWR) - Best for AIO + Perplexity in One Tracker

What it does:AWR is one of the few SEO suites that’s moved fast to integrate AI Overview (AIO) tracking alongside traditional rankings. The real bonus: it now layers in Perplexity visibility too, so you can see classic SERP shifts and AI mentions side by side.

Why SaaS teams use it: This dual view makes it strong for in-house growth teams who need to defend existing keyword visibility while also monitoring emerging AI boxes.

Instead of managing multiple dashboards, you get continuity in one place.

Free tier? No

▶️ The strengths are combined AIO + Perplexity tracking in one tool, plus the flexibility of AWR’s long-time rank-tracking customizations.

The trade-off is that AWR can feel complex for new users; it takes setup time to get the reporting tuned to your workflow.

Key Capabilities

- Tracks classic SEO rankings alongside AI Overview visibility.

- Offers highly customizable segments (device, location, engine, SERP feature).

- Supports scheduled, branded reports for internal teams and clients.

- Integrates with GA / Looker Studio / BI tools for deeper analysis.

- Handles large keyword sets with granular update frequency options.

Pricing snapshot

- Plans typically start around $139/month.

- Agency $279/month

- Enterprise $699/month

7. SISTRIX – Best for Global AIO Presence Tracking

What it does: SISTRIX has rolled out AI Overview tracking across all countries, making it one of the best options for international operations.

Why SaaS teams use it: If your SaaS serves multiple regions or markets, this is a major advantage—you’ll know whether you’re cited in the US, Germany, or Japan with the same dataset.

This kind of cross-border visibility is critical for category leaders and enterprise SaaS who need to brief execs on global performance, not just US-only data.

Free tier? No

▶️ The strength here is unmatched geographic coverage and methodological transparency.

The limitation is pricing and data depth: it excels at presence/absence but may not give you the most detailed session-level data.

Key Capabilities

- Monitors AI Overview presence across multiple international markets.

- Combines AI visibility with SISTRIX’s Visibility Index and keyword data.

- Breaks down performance by country, language, and domain.

- Surfaces competitor domains that consistently appear in AI boxes.

- Provides module-based dashboards for SEO, content, and management.

Pricing snapshot

- Main packages start at roughly €119/month.

- Plus starts from €239/month.

- Professional €419/month.

- Premium €799/month.

8. SE Ranking – Best for AIO Tracking with Source Analysis

What it does: SE Ranking’s edge is that it doesn’t just track whether your brand shows up in AI Overviews—it also logs the source content being surfaced. That means you’ll know which of your blog posts, case studies, or product pages are actually powering the answers.

Why SaaS teams use it: For SaaS growth marketers, this closes the loop: you can see whether high-effort assets are paying off in AI results, and where to prune or double down.

Free tier? No

▶️ The strength is source-level clarity, letting you attribute visibility wins to specific pages.

The downside is narrower AI coverage compared to a SISTRIX or Surfer; it’s more of a tactical tool than a global one.

Key Capabilities

- Tracks when AI Overviews and other AI answers trigger for your keywords.

- Shows which URLs (yours and others) are driving AI citations.

- Connects AI visibility with on-page audits, backlink data, and rank tracking.

- Offers white-label and scheduled reporting for agencies and in-house teams.

- Lets you scale monitoring with flexible AI check/credit limits.

Pricing snapshot

- AI Search / AI Visibility add-on from ~$52/month for small volumes.

- Higher-volume tracking up to ~$95.20/month.

- Business ~$207/month.

9. seoClarity – Best for Enterprise-scale Mentions/Cites

What it does: seoClarity has gone deep into enterprise-grade AI visibility tracking, focusing on mentions and citations across AIO and Perplexity at scale. It’s built for large marketing teams that need role-based dashboards, API access, and integration into broader SEO workflows.

Why SaaS teams use it: If you’re reporting into multiple product teams or geographies, seoClarity’s scale and automation help reduce the manual lift. Pair it with a SaaS growth experimentation program to connect mentions back to qualified pipeline.

Free tier? No

▶️ The strength is scale - multi-team workflows, automation, and integration.

The trade-off is cost and complexity, it’s overkill if you’re a lean team with just a few hubs to monitor.

Key Capabilities

- Combines enterprise SEO (technical + content) with AI Overview / Perplexity tracking.

- Measures mentions, citations, and answer presence at large keyword scales.

- Integrates with data warehouses, BI tools, and APIs for unified reporting.

- Supports role-based dashboards for execs, SEOs, content, and product.

- Includes AI-assisted workflows for prioritizing fixes and opportunities.

Pricing snapshot

- Enterprise, custom pricing only.

- Reviews cite starting packages at $2,500+/month, scaling to $4500+/month for broader bundles.

10. Nozzle – Best for Analyst-friendly Dashboards

What it does: Nozzle shines in custom reporting and analyst-friendly dashboards. For growth teams that want to slice data their own way, Nozzle gives you granular exports, flexible filters, and a strong API.

Why SaaS teams use it: It’s especially useful if you have a data team that prefers to visualize AI visibility alongside other marketing and pipeline metrics in Looker or Tableau. With Nozzle, you can plug the data straight into your BI layer without fighting rigid UI constraints.

Free tier? Yes

▶️ The strength is flexibility - if you have analysts, they’ll love the freedom.

The limitation is that it’s less plug-and-play for non-technical marketers, and the value comes only if you actually invest in custom reporting.

Key Capabilities

- Captures raw SERP and AI visibility data at very granular levels.

- Provides powerful filters (brand, feature, device, location, time) for analysis.

- Streams data to BI tools (Looker, Tableau, etc.) via API.

- Handles high-frequency tracking for volatile or mission-critical queries.

- Visualizes share-of-voice and SERP feature presence, including AI modules.

Pricing snapshot

- Smaller packages: ~$200/month.

- High-volume / “Pro Plus” tiers: up to ~$600/month.

11. Visibility.ai – Best for Startups and Lean Teams

What it does: Visibility.ai is a lightweight, budget-friendly tracker for teams that want quick insight without over-investing. It typically tracks mentions and citations across Perplexity and ChatGPT Search, with simple dashboards and easy setup.

Why SaaS teams use it: While it lacks the depth/polish of bigger players, it’s a smart entry point for teams testing whether AI visibility deserves a formal budget.

Free tier? No

▶️ The Strengths are affordable, quick onboarding, and accessible for early-stage SaaS.

Trade-offs: limited features, less accurate, and minimal historical data.

Key Capabilities

- Tracks where and how often your brand is mentioned in AI answers.

- Monitors multiple AI platforms with a simple, startup-friendly UI.

- Summarizes top prompts, queries, and categories where you appear (or don’t).

- Highlights competitors frequently mentioned alongside your brand.

- Provides lightweight dashboards and exports suitable for small teams.

Pricing snapshot

- Starter plans from around $39/month.

- Higher tiers (“Starter+” etc.) increase price with more credits and seats.

⚠️ Pricing note for your readers:

All prices are approximate as of late 2025 and can change quickly. Always confirm current pricing and tiers on the vendor’s site before choosing a tool.

If you’re unsure where to start, Book a call with The Rank Masters for a tool-fit recommendation aligned to your stage and ICP.

📋 Get Listed / Advertise

We update this guide monthly. Want your tool featured? Contact: info@therankmasters.com.

Key Features to Look for in AI Visibility Tools

Not every AI visibility tracker is built the same. Some give you surface-level insights, while others dig deep into citations, competitor benchmarking, and share-of-voice. For SaaS teams driving growth through content-led or PLG motions, the best tools balance breadth, accuracy, and usability.

The first factor to consider is platform coverage. The main AI search engines are Google AI Overviews, ChatGPT Search, Bing Copilot, Gemini, Claude, and Perplexity. Some tools cover them all, while others specialize in just one.

👉 For SaaS brands selling into multiple markets, multi-engine coverage is integral because your ICP might research in Perplexity but rely on Google AI Overviews for buying decisions (start by understanding how Search Generative Experience changes rankings so you know where coverage truly matters).

Next is distinguishing mentions vs. citations. Mentions show your brand is referenced in an AI-generated answer (good for awareness). Citations include a clickable source link to your site, which drives traffic, conversions, and measurable ROI.

Tools that separate the two give you a truer read on impact and help you prioritize content updates that will earn links, not just name-checks.

💡 Another pillar is share-of-voice (SOV). Presence alone isn’t enough, you need to know how often you appear vs. competitors on the queries that trigger demos and trials.

The strongest platforms surface trendlines, so you can tell whether you’re gaining ground or losing it (and they help you prioritize queries using a visibility-first keyword framework rather than chasing vanity terms).

Because AI answers can change overnight, frequency & history matter. Favor tools that refresh daily or weekly and preserve historical baselines. That way, you can spot spikes, drops, and patterns instead of relying on snapshots.

👉 Pair tracking with AI content audit software to flag pages that are losing citations and to trigger structured fixes.

Finally, the tool has to be practical. Reporting and alerts should save your team time, not create more manual work.

Look for ready-to-share dashboards, scheduled exports, and automated notifications when visibility shifts.

▶️ If you need help operationalizing this layer of playbooks, dashboards, and recurring reviews, an AEO consulting agency can plug in alongside your content ops and analytics.

Choose Your Tracker by Team & Stage: A Persona-Based Buyer’s Guide

Choosing the right AI visibility tracker depends less on “which tool is best overall” and more on who you are, how your team operates, and what stage your company is in.

A VP of Marketing at a Series C SaaS will prioritize different outcomes than a scrappy Seed-stage founder or an agency lead managing multiple accounts.

Here’s how to frame the decision: 👇

1️⃣ If You’re a Brand Manager (In-House, Growth-Stage SaaS)

Your biggest challenge is often competitive pressure. The board or exec team wants to know: “Why are our competitors being mentioned in AI results but we’re not?”

Use a tracker that gives head-to-head SOV and pair it with a defensible query set built via our SaaS keyword research workflow so you’re measuring the right moments of discovery.

Best Fit: Rankability’s Perplexity Tracker

Why: It gives you head-to-head share-of-voice data, showing exactly how your visibility compares to competitors inside Perplexity answers.

Outcome: You can identify gaps, build cases for more content/PR investment, and reassure leadership with hard data.

2️⃣ If You’re an Agency Lead (Managing SaaS Clients)

Your challenge is scale and reporting. Clients expect you to not only track visibility but also deliver polished, executive-ready reports.

Consider stacking your tracker with execution support from SaaS content marketing services to operationalize fixes and monthly roll-ups without adding headcount.

Best Fit: Profound AI Visibility

Why: It offers multi-client dashboards, white-label exports, and scheduled reporting that save hours of manual work.

Outcome: You can turn complex AI visibility data into client-ready insights that justify retainers and strengthen relationships.

3️⃣ If You’re a Startup Marketer (Seed–Series A SaaS)

Your biggest constraint is budget and bandwidth. You don’t need enterprise dashboards yet, you just need directional signals.

Track the few queries that actually map to sign-ups and set expectations with the SaaS blog ROI timeline to avoid over- or under-investing.

Best Fit: Visibility.ai (or other lightweight early-stage tools)

Why: Affordable, quick to set up, and simple enough for small teams.

Outcome: You’ll get directional insights without overcommitting budget, and you can upgrade to broader platforms later if AI search visibility proves to be a growth lever.

💡 Pro tip for all stages: When you spot a visibility gap, run a 30–45 day fix sprint to repair cannibalization, refresh out-of-date sources, and tighten topical relevance with the SaaS content audit & fix sprint before you re-measure SOV.

Brand Visibility in AI Search: What It Is and Why You Should Track It

Brand visibility in AI search is how often and how prominently your brand appears inside AI-generated answers. It’s a new layer on top of classic SEO visibility.

- Mentions: your brand name appears in the generated text (awareness, not always clickable).

- Citations: your site/content is credited as a source with a link (traffic + credibility).

- Share-of-Voice (SOV): your brand’s visibility vs. competitors across a set of key queries.

Imagine a buyer asks Perplexity: “What are the best B2B SEO agencies for SaaS?” If a competitor is cited and you’re not, that’s a lost trust moment. If your brand is cited repeatedly, you earn credibility at the exact discovery moment, see our AI SEO BOFU case study to understand how citations convert bottom-of-funnel intent.

▶️ AI search is now mainstream. Google’s AI Overviews are live globally, and discovery is shifting across ChatGPT, Perplexity, and Bing Copilot. If you’re building a measurement plan, start with Google SGE and SEO to grasp what’s changed and why rankings alone no longer tell the full story.

Unlike static rankings, AI answers are dynamic, the brand cited today might vanish tomorrow. That volatility demands continuous monitoring and content structured for extractability and credibility with answer engine optimisation so answer engines consistently select and cite you.

💡 From a SaaS growth perspective, the stakes are clear:

- Missed pipeline: if you’re absent in AI results, competitors capture those SQLs.

- Lost authority: citations signal expertise (see Google SGE E-E-A-T importance for how trust signals still matter in AI-generated contexts).

- Weakened brand moat: if execs don’t see your brand when they search, credibility takes a hit.

Simply put: if you’re not measuring brand visibility in AI search, you’re flying blind while competitors steal attention.

Why AI Visibility Tracking Matters for Teams (and How to Start in a Week)

For teams, AI answers increasingly replace the click-through journey:

- Prospects ask Perplexity / ChatGPT, “What are the best tools for X?”

- AI summarizes the landscape and names a few vendors.

- If you’re not named or cited there, you never enter the consideration set.

Tracking AI visibility helps you:

- Protect pipeline – see where competitors are winning “best tools” / “alternatives to” queries in AI.

- Prioritize content – focus refreshes on pages that have impressions but no citations in AI answers.

- Measure brand moat – quantify share-of-voice vs competitors inside AI responses, not just blue links.

Catch hallucinations – spot when AI tools mis-state your pricing, ICP, or positioning and fix the inputs.

The good news? You don’t need months of setup to start measuring your AI search visibility. In fact, you can build a baseline view in just one week.

A 7-Step Framework to Get Your AI Visibility Baseline

Here’s a step-by-step approach designed for SaaS growth teams:

Step 1: List Your Top 10–20 Keywords

Start with the queries that move the pipeline, those tied to demo requests, free trials, or SQLs. If you need a fast way to shape the list, use our keyword research workflow for SaaS startups to approach and capture BOFU, comparison, and alternatives terms.

Example: A PLG SaaS might include “best product analytics tools” or “alternatives to [competitor].”

Why it matters: Appearing in AI answers for these queries translates directly to conversions, not just impressions.

Step 2: Choose the AI Platforms That Matter Most

Not every AI engine is equally important for your audience.

- Google AI Overviews → mass-market visibility.

- ChatGPT Search → top-of-funnel discovery and broad research queries.

- Perplexity → mid-funnel evaluation, popular with technical buyers.

- Bing Copilot → strong in enterprise/desktop environments.

Pick the ones that align with where your ICP searches. For example, if your product is developer-facing, Perplexity should be a priority.

Step 3: Select a Tool That Covers Those Engines

Match your platform choices with the right tracker:

- Multi-engine coverage? → Surfer AI Tracker

- Deep Perplexity insights? → GrowByData or Rankability

- Agency/enterprise reporting? → Profound

- Budget-friendly experiment? → Visibility.ai

Choosing the right tool makes sure you’re not just collecting data (you’re collecting the right data for your motion).

Step 4: Run a Baseline Test and Log Your Visibility

Before optimizing, capture your “day-0” status: which keywords return AI answers, whether you show up as a mention or citation, and how often competitors appear instead.

For a repeatable logging workflow, pair this with how to do a content audit so your notes roll into fixes, not just screenshots.

Step 5: Set Up Weekly Alerts for Visibility Changes

AI search results shift constantly. If your brand disappears from a key query overnight, you need to know.

- Configure alerts so you get notified of major visibility changes.

- Run a weekly review with a simple SEO content operations doc so your team triages changes without chaos.

This keeps your team proactive, not reactive.

Step 6: Benchmark Against Competitors to See Gaps

Your visibility doesn’t exist in isolation. The question isn’t just “Are we visible?” but “Are we more visible than the competition?”

- Track competitors’ mentions and citations alongside your own.

- Identify gaps (e.g., they appear in “best alternatives” queries and you don’t).

- Use that insight to guide campaigns.

For SaaS marketers, this is board-level storytelling: you’re not just tracking visibility, you’re showing market position.

Step 7: Feed Insights into Strategy

AI visibility data is only useful if it changes what you do. Once you spot gaps:

- Update content: Create assets designed to earn citations in AI answers.

- Strengthen PR: Pitch stories or research that AI systems may pick up.

- Adjust partnerships: Collaborate with cited sources to increase brand mentions.

- Use a spreadsheet-friendly B2B SaaS content audit checklist to keep fixes moving and measurable.

Over time, this makes AI visibility not just a reporting metric but a growth lever tied to SQLs and ARR.

▶️ By following this framework, your team can go from zero visibility insight to actionable data in just one week, without overwhelming your existing workflows.

How We Test & Compare These Tools

We test on four axes tied to your demand profile: (1) engine coverage (Google AI Overviews first; Perplexity next), (2) handling of mentions vs citations, (3) alerting/reporting quality for teams, and (4) competitive context (who else is cited on the same query).

We use your active query set as the benchmark: “ai search tracker,” “ai search visibility tool,” “ai brand visibility tool,” “ai visibility tool,” and the broad “search visibility tool.”

A tool ranks higher when it can (a) reliably detect AIO presence for a query, (b) tell us if your domain is cited vs merely mentioned, (c) alert changes on those terms, and (d) export reports a PM or client can read without training.

Frequently Asked Questions

A tool that tracks when AI answers appear and whether your brand/pages are mentioned or cited inside them.

Yes, but coverage differs by tool. Surfer AI Tracker and Profound offer stronger global monitoring. This is especially important for SaaS brands serving multiple regions since AI Overviews may vary by market.

These tools provide directional insights rather than perfect precision. AI answers change frequently, so trackers simulate queries on a daily or weekly basis. This allows SaaS teams to see visibility patterns and competitive shifts, even if exact outputs fluctuate.

Yes, AI visibility doesn’t replace SEO, it complements it. SEO tracking shows how you rank in traditional search results, while AI visibility reveals whether your brand is present in AI-driven summaries. Together, they provide a complete picture of discoverability.

As of March 2025, Google showed AI Overviews on ~13.14% of queries (up from 6.49% in January). Prevalence fluctuates by intent and over time, so revisit this stat when you update the post.

No. In a July 2025 analysis of 10M AIO SERPs across 10 countries, 8.64% of AI Overviews appeared below #1 (as low as position #6); 91.36% were at #1.

Generally, yes. Pew (Mar 2025 usage panel) found users clicked a traditional result 8% of visits when an AI summary appeared vs 15% without one (links inside summaries were clicked ~1% of visits). Separately, Ahrefs saw ~34.5% lower CTR for position #1 on AIO queries comparing Mar 2024 vs Mar 2025.

A mention is when an AI answer names your brand without a clickable source. It can shape brand perception/recall but is hard to attribute. A citation is when the AI answer links to your page among its sources (Google states AIOs include “links to the web”). Citations are trackable and the only route to direct referral traffic—even if link click rates inside summaries are modest. Prioritize earning citations, while monitoring mentions for brand coverage and sentiment.