In B2B SaaS, your content-led and PLG growth motions live and die on organic acquisition.

“Ranking reports aren’t vanity metrics” the best SEO reporting software turns them into one of the clearest signals that your content engine is moving buyers closer to activation. Every movement in search visibility ties directly to pipeline health: SQL volume, ARR expansion, and trial conversions.

💡 But here’s the challenge: most SaaS teams still struggle to make this connection clear. They can say, “we published X blog posts” or “we rank #5 for this keyword” but they can’t easily prove, “this keyword moved up, it drove Y more signups, and contributed Z to ARR.”

👉 Without instrumentation from a top rank tracker for SaaS SEO and clean data joins, that’s the missing link between marketing activity and growth outcomes. A specialized SaaS SEO agency can help wire this up end-to-end so leaders trust the numbers.

This expert guide will help you close that gap. You’ll learn how to:

- Pick the right keyword ranking tool for SaaS growth.

- Build clear, repeatable reports that translate keyword movements into SQLs, trials, and ARR growth.

- Avoid common anti-patterns — adopt a zero-click SERP keyword strategy to stay focused on high-intent visibility instead of vanity keywords.

Table of Contents

Decision Table: GSC vs. Rank Tracker vs. All-in-One

Short answer:

- GSC + Looker Studio = fastest, most trustworthy snapshot of how your site actually performs on Google, free.

- Rank trackers (Semrush, AWR, Nozzle, ProRankTracker, SERPWatcher) = better for daily tracking, competitors, device/location grids, and alerts.

| If you need… | Best choice | Why | Notes |

|---|---|---|---|

| A free, credible report today | GSC → Looker Studio | Official Google data; quick share links | Average position = average of the top seen result across impressions. |

| Daily refresh + alerts | Semrush / AWR / Nozzle | Scheduling, notifications, device & geo filters | Tool data can differ from what you see due to location/personalization. |

| Local grid/map rankings | Local-focused trackers (BrightLocal, Local Viking) | Visual heatmaps, multi-location reporting | “Local results differ by user location.” |

| Competitive visibility reports | Semrush / Ahrefs / Nozzle | Competitor SERP share + tags/clusters | Use with GSC for accuracy sanity-checks. |

| White-label client PDFs | Advanced Web Ranking / ProRankTracker | Custom, scheduled, branded reports | Pricing varies by keywords/projects. |

The Best Keyword Ranking Tracking Tools in 2025 (Free → Enterprise Suites)

Below, we break down the tools by category so you can pick what best fits your stage “anchored to an ROI-first SEO tool stack for SaaS that keeps rankings → traffic → pipeline tightly connected”.

| Tool | Use Case/Best For | Key Strengths |

|---|---|---|

| Google Search Console | Seed-stage SaaS, beginners | Accurate, direct Google data, easy setup |

| Google Keyword Planner | Early-stage keyword discovery | Search volume + idea generation |

| LowFruits | Small SaaS teams, marketers | Affordable, simple tracking |

| SE Ranking | Growth-stage SaaS content teams | Competitor gaps, customizable reporting |

| SERPWatcher (Mangools) | SaaS teams new to SEO | Beginner-friendly interface, visual reports |

| Semrush | Agencies, scaling SaaS (Series B+) | Enterprise-grade features, automation |

| Ahrefs | PLG SaaS, competitive markets | Strong backlinks + content gap insights |

| Moz Pro | Agencies & SaaS consultants | Clean reporting, client-friendly outputs |

What’s the best SEO tool for keyword ranking reports?

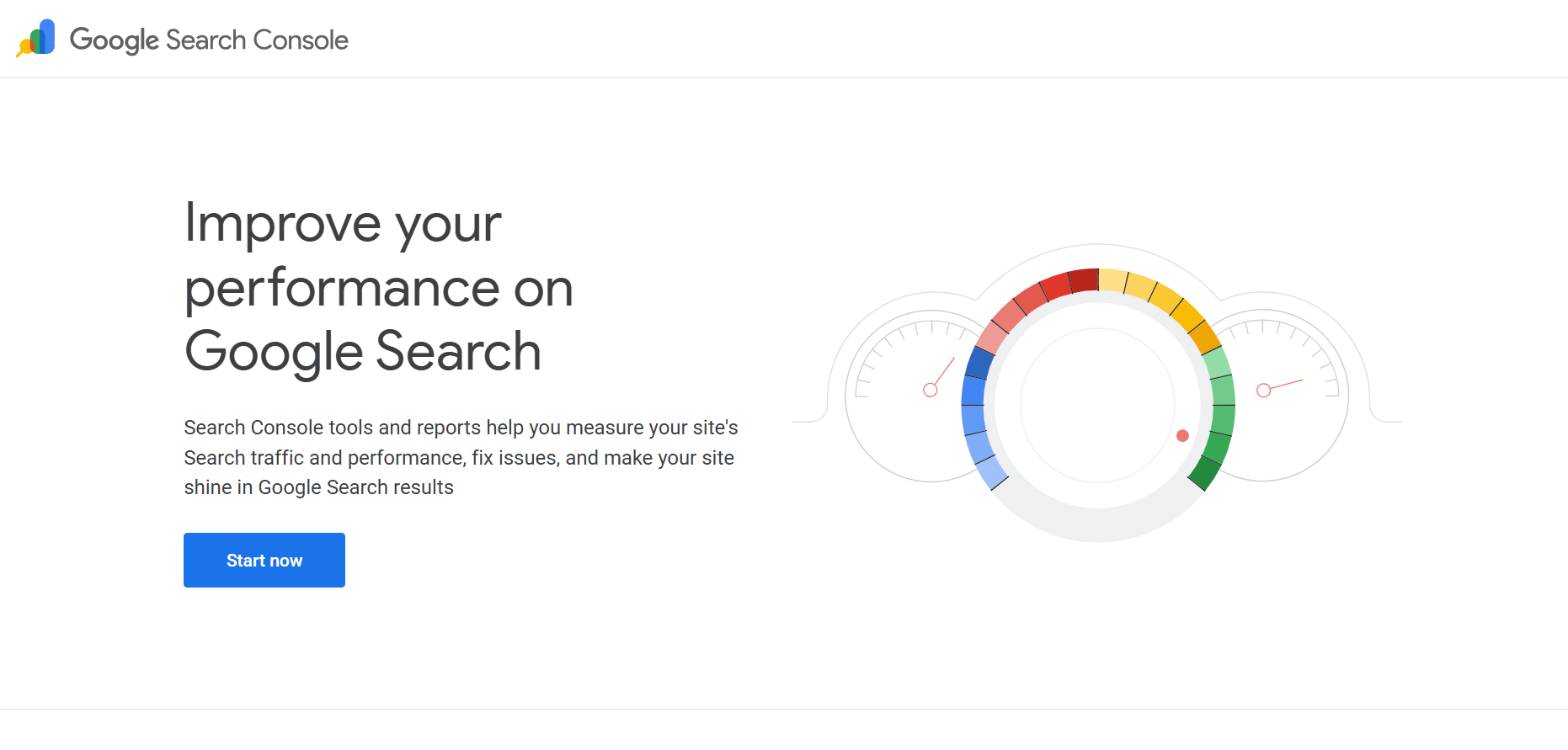

Use Google Search Console for the most accurate, free ranking data from Google, then pipe it to Looker Studio for shareable reports.

Choose a rank tracker (e.g., Semrush, Advanced Web Ranking, Nozzle) when you need daily refreshes, competitor views, local grids, or custom alerts.

To implement:

1) Connect GSC → Looker Studio

2) Add filterable tables

3) Schedule email

📋 Get Listed / Advertise

We refresh this guide monthly. Want your tool featured, benchmarked, or cited? Email: info@therankmasters.com

• Subject: “Rank Tracker Listing – TRM”.

1. Google Search Console: The Essential Free SEO Baseline

Google Search Console (GSC) is the baseline reporting tool every SaaS company should use. It provides direct insights from Google on keyword impressions, clicks, and average positions.

While it won’t show competitor performance or deliver advanced reporting, it’s free, accurate, and integral for proving initial organic traction.

💡 Best for: Seed-stage SaaS validating organic demand and reporting early wins to leadership.

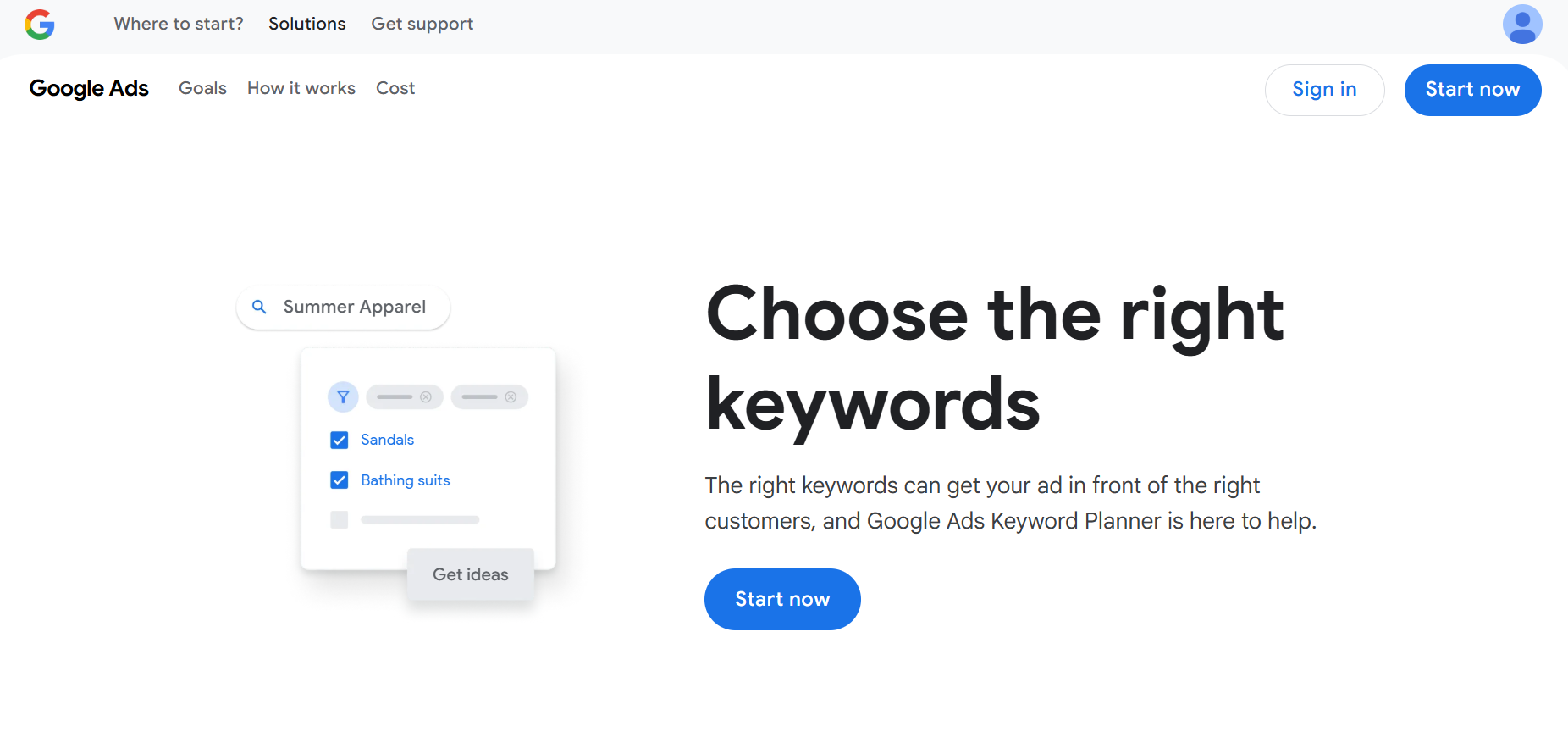

2. Google Keyword Planner: Free Demand Validation Tool

Google Keyword Planner, though designed for ads, is still a valuable keyword discovery tool. It helps SaaS teams identify search demand, estimate keyword volumes, and uncover content opportunities.

It’s not a ranking tracker, but it’s great for building content roadmaps that align with your ICP’s search behavior.

💡 Best for: Early SaaS teams building content calendars around high-intent topics.

3. LowFruits: Affordable Visibility Tracking for Lean Teams

LowFruits is a lightweight, affordable keyword tracker that works well for smaller SaaS marketing teams.

It strips away complexity and focuses on showing whether your core keywords are moving. Perfect when you’re trying to show progress without investing in an enterprise suite.

💡 Best for: SaaS startups post-seed looking for quick, affordable visibility into keyword performance.

4. SE Ranking: Mid-Tier Tracker That Proves ROI to Execs

SE Ranking is a favorite among growth-stage SaaS companies because it balances affordability with robust features.

It offers competitor gap analysis, keyword clustering, and customizable reporting, use it alongside our SEO rank tracking software comparison to benchmark daily/weekly update options.

For in-house SaaS teams, this makes it easier to tie keyword improvements back to SQLs and ARR metrics when reporting to execs.

💡 Best for: Series A–C SaaS teams scaling content programs and needing to prove ROI from SEO.

5. SERPWatcher (Mangools): Simple Dashboards for Content Marketers

SERPWatcher is designed with simplicity in mind. Its clean interface and visual dashboards make it ideal for content marketers who want to see the impact of SEO without sifting through overwhelming data.

It’s particularly useful for SaaS teams new to rank tracking, as it reduces reporting friction for smaller teams.

💡 Best for: Growth-stage SaaS teams with junior marketers or lean content teams.

6. Semrush: Enterprise-Grade All-in-One SEO Suite

Semrush is the all-in-one SEO powerhouse. It goes far beyond rank tracking: content planning, technical audits, backlink analysis, and competitor benchmarking are all built in.

For SaaS companies managing multiple geographies, product lines, or investors demanding board-ready reporting, Semrush delivers scalability and professional-grade automation, plus add-ons when you outgrow basics.

💡 Best for: Scaling SaaS (Series B+) or agencies serving SaaS clients that need enterprise-grade SEO coverage.

7. Ahrefs: Competitive Intelligence & Backlink Powerhouse

Ahrefs is the tool of choice for SaaS companies that rely heavily on competitive content strategies and backlink acquisition.

It excels at identifying content gaps, spotting competitor moves, and providing deep backlink intelligence, especially useful for PLG motions where organic visibility and links directly influence signups.

If you’re tracking brand share across new surfaces, fold in AI search visibility tools as a complementary view.

💡 Best for: PLG SaaS companies in competitive markets that need strong content gap and backlink data.

8. Moz Pro: Clean, Client-Friendly Reports for SaaS & Agencies

Moz Pro offers clean, client-friendly reports that agencies love. For SaaS in-house teams, it’s a solid option if you want actionable keyword insights without the complexity of Semrush or Ahrefs.

Moz Pro’s reporting is particularly useful when you need to share results with execs or investors who want clarity without technical overload.

💡 Best for: Agencies serving SaaS clients or Series B+ SaaS companies balancing internal SEO with external support.

📋 Get Listed / Advertise

We refresh this guide monthly. Want your tool featured, benchmarked, or cited? Email: info@therankmasters.com

• Subject: “Rank Tracker Listing – TRM”.

Step-by-Step: 5-minute GSC → Looker Studio

Open GSC and filter by Search type: Web and your target page or folder.

Export → Looker Studio (or connect the GSC connector directly) and select Queries and Pages.

Build the view: a) scorecard for Clicks/Impressions/CTR/Avg Position, b) table with Query, Clicks, Impressions, CTR, Position, c) date range control.

Add filters (brand vs. non-brand, country, device) and a page-level filter for the URL.

Schedule email delivery to stakeholders (weekly/monthly).

Checkpoint: confirm that numbers match GSC for the same filters; newest data can be preliminary.

What Makes a Good Keyword Ranking Tool? 6 Non-Negotiable Features

For a SaaS team, choosing the right keyword ranking tool isn’t about bells and whistles “it’s about finding a solution that makes it easier to connect rankings → traffic → pipeline”.

Here are the non-negotiables:

- Accuracy – You need real, reliable search engine data. If the tool gives “averages” or slow updates, your team risks reporting wins or losses that don’t actually exist.

- Ease of Use – Busy SaaS growth teams don’t have hours to interpret a cluttered dashboard. Reports should be clear enough for a marketer to act on and simple enough for a founder or board member to skim.

- Updates – Daily or weekly tracking ensures you can see whether your product-led content pushes are moving the needle in time for board reporting or growth reviews.

- Competitor Tracking – In B2B SaaS, you’re almost always fighting 2–3 direct competitors for trial-intent keywords. A good tool shows you where they’re winning and where you can overtake them.

- Reports & Sharing – Agencies need white-label exports; in-house teams need lightweight dashboards. Either way, being able to share results with sales, growth, or leadership is critical, standardize reporting with SaaS SEO reporting tools.

- Price & Value – Seed-stage teams can’t justify $500/month suites. Growth-stage SaaS with multiple product lines can. The “best” tool is the one that matches your budget and stage without overcomplicating your workflow.

How to Choose the Right Tool for Your SaaS Stage (Seed → Enterprise)

For SaaS teams, the “best” keyword ranking tool isn’t universal, “it depends on your growth stage, motion (content-led or PLG), and resourcing mix (in-house vs. agency support)”. Think of tool choice as an evolution that grows with your ARR and SEO maturity.

If You’re a Beginner / Early SaaS (Seed–Series A)

At this stage, your focus is on proving that organic can drive sign-ups or trials. Budgets are lean, and your team is small.

The best move here is to stick with Google Search Console + Keyword Planner, and follow a repeatable SaaS keyword research workflow to track early-traction keywords (e.g., “what is [category] software”).

These tools won’t show you competitor data, but that’s okay “the priority now is validating demand, not outspending rivals”.

If You’re a Growth-Stage SaaS (Series A–C)

Once you’re scaling traffic, publishing regularly, and your board is asking about SEO ROI, free tools quickly hit their limits. This is where mid-tier trackers shine. They’re cost-efficient but allow you to:

- Track hundreds of trial-intent and comparison keywords

- Spot competitors who are outranking you

- Generate reports your growth team can plug into performance reviews

For growth-stage SaaS, these tools bridge the gap between proving content performance and defending SEO budgets at the exec table.

If You’re an Agency Partner or Scaling SaaS With Complex Needs

When you’re managing multiple geographies, product lines, or operating with an external partner, you’ll need enterprise-grade insights.

Suites that integrate with analytics, automate reporting, and enrich competitor intelligence at scale are your friend, and when bandwidth is tight, partnering with SaaS SEO specialists helps you wire rankings → trials → pipeline with confidence.

👉 Think of it as a maturity curve

Start with free → graduate to mid-tier tools → move into enterprise suites as your ARR and SEO complexity grow.

That way, you’re never overpaying for features you don’t need, but you’re also never under-equipped when growth depends on SEO.

Accuracy, Position & Why Results Differ (Free + Paid Tools)

What “Average position” means?

In Google Search Console (GSC), average position is the average of the topmost result your URL earned across all impressions for a query. It’s not a single rank—it’s a blended number that moves as you gain new impressions.

Fresh vs. final data: Difference

GSC now shows data that’s less than a day old, but very recent points can be preliminary (marked with a dotted line) and may settle after processing. When reporting, note that early data can change.

Why your rank differs across tools (and even devices):

- Location & language: Google tailors results by country/region and language; local packs and map results vary by where the search originates.

- Personalization: Google may adjust results based on recent activity; you can even test “without personalization.” Expect some variance.

- Device context: Mobile vs. desktop SERPs differ (layout, features, local blend), shifting what’s “topmost.” (Inference grounded in Google’s personalization/location guidance.)

- Metric apples-to-oranges:

- GSC reports an average position across impressions.

- Rank trackers capture snapshot checks from specific locations/devices at specific times, often with competitor views and refresh schedules (daily/weekly). Align the window and metric before comparing.

How to make reports trustworthy:

- Always state country, device, and date range.

- In GSC, segment page AND query; in trackers, specify location/device/frequency.

- For executive views, pair Clicks, Impressions, CTR with Average position so trends aren’t misread.

Common Pitfalls & Fast Fixes: Keyword Ranking Report Mistakes

1️⃣ Mistake: Treating average position as a precise rank.

Fix: Explain it’s an impression-weighted average and pair with Clicks, Impressions, and CTR to show real impact.

2️⃣ Mistake: Comparing a daily tracker snapshot to GSC’s monthly averages.

Fix: Align time windows and metrics (snapshot vs. averages); annotate any methodology changes.

3️⃣ Mistake: Ignoring location/device differences.

Fix: Split GSC reports by country/device; in trackers, lock a city/ZIP and device. Use local grid tools for map visibility.

4️⃣ Mistake: Reporting on fresh (preliminary) data without a disclaimer.

Fix: Add a note when charts include the most recent, still-processing data; finalize reports after processing.

5️⃣ Mistake: Mixing brand and non-brand queries.

Fix: Create filters/segments so brand demand doesn’t mask non-brand movement.

6️⃣ Mistake: Overloaded tables that hide signal.

Fix: Keep an executive summary (top queries, movement, winners/losers) and push detail to a secondary tab.

7️⃣ Mistake: No competitor or SERP feature context.

Fix: Use a tracker for competitor positions and SERP features; reference GSC for performance reality.

8️⃣ Mistake: No annotations for site changes.

Fix: Maintain a simple changelog (releases, content launches, link campaigns) so rank swings are explainable.

9️⃣ Mistake: KPI sprawl (too many charts, no outcome).

Fix: Standardize on Clicks, Impressions, CTR, Avg Position + one business KPI (leads/sales) and call out only meaningful deltas.

Best Practices: Turning Keyword Reports Into SaaS Growth Levers

A keyword ranking tool is just the instrument. The real impact comes from how your SaaS team uses those reports to influence growth, prove ROI, and align marketing with revenue goals.

For mid-market and growth-stage SaaS companies, here’s how to ensure ranking reports are more than vanity charts:

1. Focus on Trends, Not Daily Fluctuations

SaaS growth is measured in ARR, SQLs, and trial conversions, not whether you slipped from position 8 to 9 overnight. Daily fluctuations are noise.

What matters is whether your category-defining and trial-intent keywords are trending up consistently across weeks or quarters.

This longer view (see the SaaS blog ROI timeline) helps you see if your content-led growth motion is compounding, or if you’re plateauing and need to pivot.

Example: A Series B SaaS in the analytics space tracked quarterly ranking shifts for 50 “trial-intent” queries. Instead of panicking over daily dips, they noticed steady growth from positions 20 → 10, which correlated with a +15% lift in trial activations.

2. Prioritize Keywords That Drive Pipeline, Not Just Traffic

Not all keywords deserve equal attention. Growth-stage SaaS teams should focus on:

- Trial-intent terms → e.g., “best API monitoring tool for SaaS”. These keywords drive free signups and product activations.

- Problem-solution queries → e.g., “how to reduce SaaS churn”. These position your product as the answer to pain points.

- Comparison and alternatives queries → e.g., “[Competitor] alternative”. These often convert at higher ACVs because prospects are already solution-aware.

Tracking these keywords consistently ensures you’re not just “growing traffic” you’re growing qualified traffic tied to revenue. Use a SaaS content marketing framework to map queries to funnel stages and keep reporting focused.

3. Monitor Competitors Relentlessly to Protect ARR

In SaaS, rankings are a zero-sum game. If your competitor overtakes you for a high-intent keyword, it’s not just an SEO issue “it’s a pipeline leak”. A good ranking report highlights competitive shifts so you can react fast:

- Update or expand content (guided by a SaaS content pruning strategy).

- Build supporting pages (integrations, use cases).

- Layer in link-building or paid search for reinforcement.

Example: A growth-stage PLG SaaS noticed a rival outranking them for “best onboarding software.” By spotting it early in their ranking reports, they refreshed their comparison page and regained top 3 placement within a quarter “protecting an estimated $200K in ARR pipeline”.

4. Tie Keyword Data Back to Business Strategy

Raw ranking data won’t impress your leadership team. Instead, translate it into business outcomes and next steps. Ranking reports should inform decisions like:

- Which blog posts to refresh to defend must-win queries.

- Which content gaps to prioritize where competitors are winning.

- Which integration or feature pages to build for higher funnel coverage.

To accelerate execution, roll these actions into a SaaS content audit & fix sprint so improvements actually land before the next board review.

👉 Pro Tip for SaaS Teams: Don’t keep ranking reports siloed in marketing. Share them with growth and sales leadership. Showing the chain of keywords → traffic → trials → SQLs → ARR builds trust in your SEO motion, makes it easier to defend budgets, and aligns everyone on what’s really moving the needle.

Frequently Asked Questions

Because rankings are directly tied to pipeline outcomes. Tracking keyword performance shows you whether your content is driving SQLs, trial signups, and ARR growth. Without ranking reports, SaaS teams can’t prove which keywords are fueling acquisition, making it harder to defend SEO budgets or optimize content strategy.

For scaling teams, Semrush and Ahrefs are the top picks. They provide enterprise-grade features like competitor gap analysis, backlink tracking, and integrations with CRMs and analytics. This makes it easier to prove SEO’s contribution to ARR across geographies, products, and buyer segments.

Yes. Sharing ranking reports with sales leadership shows where the market is searching and which competitors are gaining visibility. This makes it easier for sales teams to understand prospect intent and for marketing to justify content decisions.

Not really. SaaS buyers don’t shift overnight. Weekly tracking is usually enough to spot meaningful trends. Daily updates may help in ultra-competitive categories, but most growth-stage teams should focus on consistent reporting over time.

They estimate rankings from specific locations/devices. Expect differences vs. your own results due to personalization and location. Validate with GSC.

Weekly for stable sites; daily if you run experiments, publish often, or manage many locations. Use alerts to catch big swings.

Google tailors results by location/device and continually updates its systems, which is why fluctuations in the rankings are normal.