If you’re searching “best AI tools for marketing research,” you’re not shopping for “cool AI.” You’re trying to turn messy signals—audience data, surveys, SERPs, trends, and customer feedback, into decisions you can ship:

- Sharper positioning (what to claim + who it’s for)

- Better content topics (what will rank + convert)

- Stronger campaign angles (what to test + why it will work)

- Messaging that actually converts (headlines, objections, proof)

This guide is built to save you weeks of spreadsheet chaos and transcript overwhelm by showing which tools do what, where they fit, and how to use them in a real workflow—especially if you’re building a pipeline engine with SaaS content marketing and need research that leads to revenue (not dashboards).

If you want the “research → page copy → conversions” bridge, our CRO + Product-Led Content workflow is built for that.

Who This Is For (and the Exact Job-to-Be-Done)

This roundup is built for:

- B2B SaaS marketers (growth, SEO, content, PMM) who need research that translates into pipeline—often alongside a SaaS SEO agency motion

- Agencies / consultants doing audits, strategy, and retainers

- MarTech / tool vendors who need sharper messaging, competitive intel, and category demand signals

Job-to-be-done behind the query:Help me choose AI tools that turn market signals (audiences, surveys, SERPs, trends, VOC) into clear decisions—fast—so I can create better positioning and content that converts.

If you want help picking + implementing the stack: Book a call or grab the checklist and do it in-house.

5 Best AI Tools for Marketing Research (Quick Shortlist)

These five tools cover the main jobs in marketing research: audience insights, customer feedback, SEO demand, and trend discovery. Use the table below to match each tool to your goal, then apply the micro-workflows to turn insights into content and leads.

| Tool name | key strengths | Use case |

|---|---|---|

| GWI Spark | Data-backed audience insights (survey-based) • Fast persona/positioning discovery • Chart/deck-ready outputs for stakeholders | Build an ICP persona + messaging claims (motivations, barriers, preferences) for a new landing page or campaign |

| SparkToro | Finds where audiences spend attention • Great for distribution/partnership targeting • Turns vague personas into concrete channel lists | After publishing a “best tools” roundup, identify podcasts/sites/creators to pitch for mentions, backlinks, and partnerships |

| SurveyMonkey | Easy survey creation + distribution • AI helps summarize results + extract themes from open text • Stakeholder-friendly reporting/exports | Run a quick market research survey to uncover top pains/objections and turn them into H2s, FAQs, and ad angles |

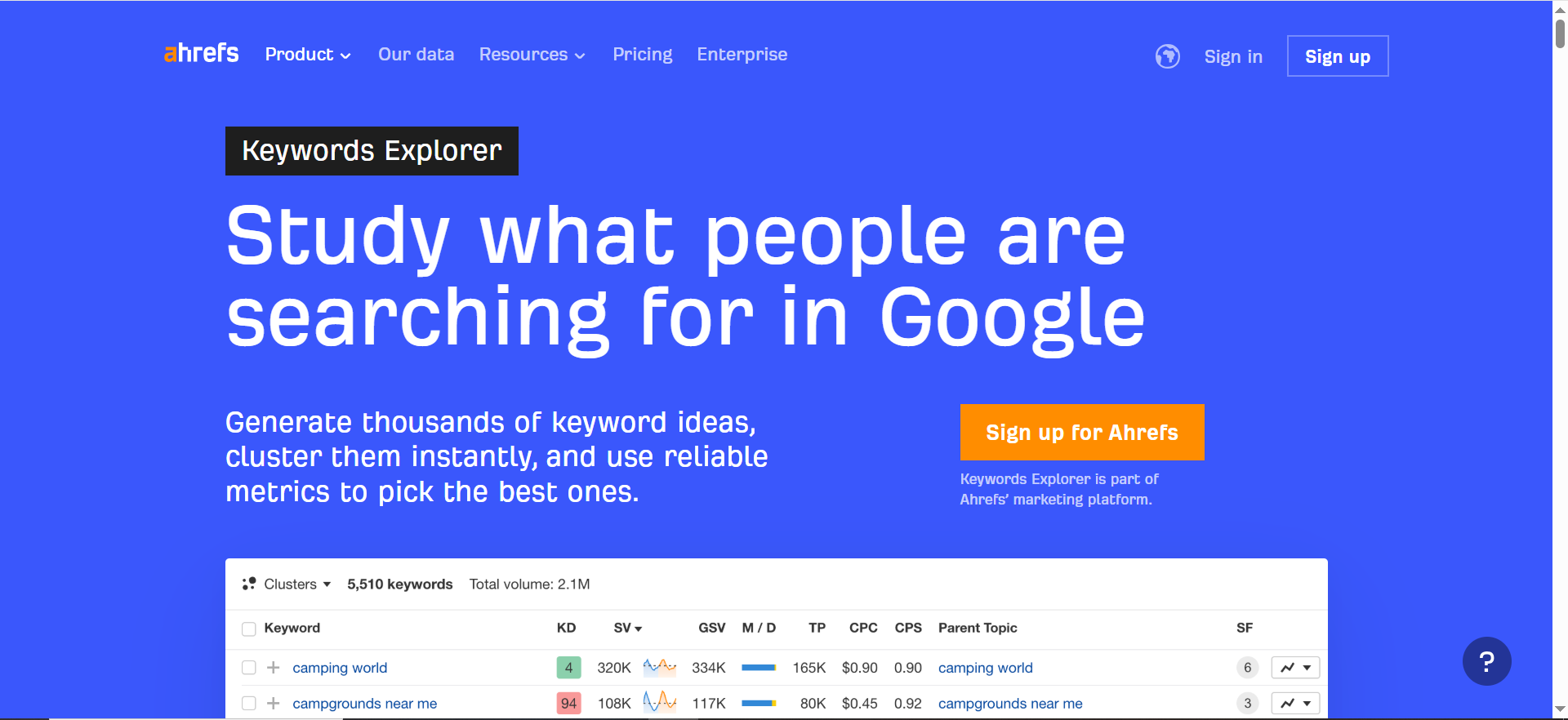

| Ahrefs Keywords Explorer | Strong for high-intent keyword discovery • SERP reality checks (what ranks and why) • Helps build winnable content clusters | Plan BOFU pages (“best/vs/alternatives/for persona”) and map a content cluster that can realistically rank |

| Exploding Topics | Early trend discovery (spot what’s rising) • Helps find new tool categories to cover • Great for staying ahead of saturated SERPs | Discover emerging AI marketing research tools/categories for “2026 picks,” then validate and publish before competitors |

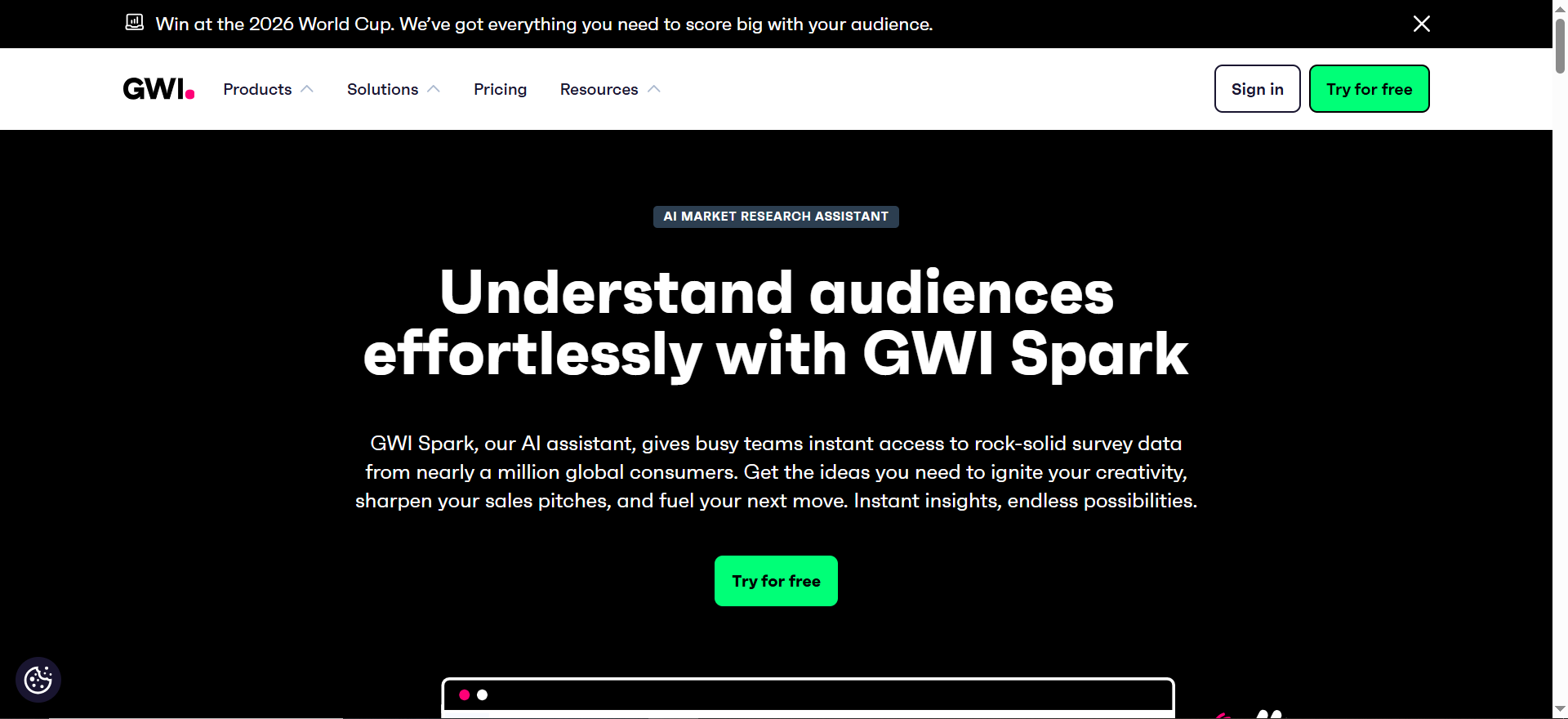

1) GWI Spark (Audience / Persona Research)

What is it?

An AI-powered market research assistant built on GWI’s large consumer survey datasets—think of it as “ask questions, get insights” but anchored to structured survey data rather than random web text.

What it does?

You type a question about an audience—motivations, behaviors, preferences, barriers—and Spark returns data-backed insights and charts you can use for personas, positioning, and stakeholder decks.

Best for: Marketers who need data-backed personas and “why they buy” insights quickly—without running a brand-new survey from scratch.

Key AI features:

- Ask questions in plain English and get insights based on GWI’s survey data (motivations, barriers, brand affinities, etc.).

Integrations/exports:

- Built for sharing via GWI Canvas decks (stakeholder-friendly reporting format).

Free tier:

- Free plan includes 5 Spark prompts/month, charts, and unlimited Canvas decks.

Pricing tier:

- Mid → Enterprise (paid tiers typically unlock deeper access and team workflows).

Strengths:

- Strong “proof layer” for messaging and ICP narratives

- Very fast time-to-insight for strategy work

Trade-offs:

- Best for macro/audience patterns—still validate your specific ICP with first-party VOC (calls, surveys, support tickets)

Use it like this (micro-workflow):

- Ask: “What triggers [persona] to look for [solution]?”

- Pull 3–5 supporting data points (needs, barriers, traits).

- Turn into landing page blocks: Outcomes (desired results), Objections (barriers), Proof (data-backed claims).

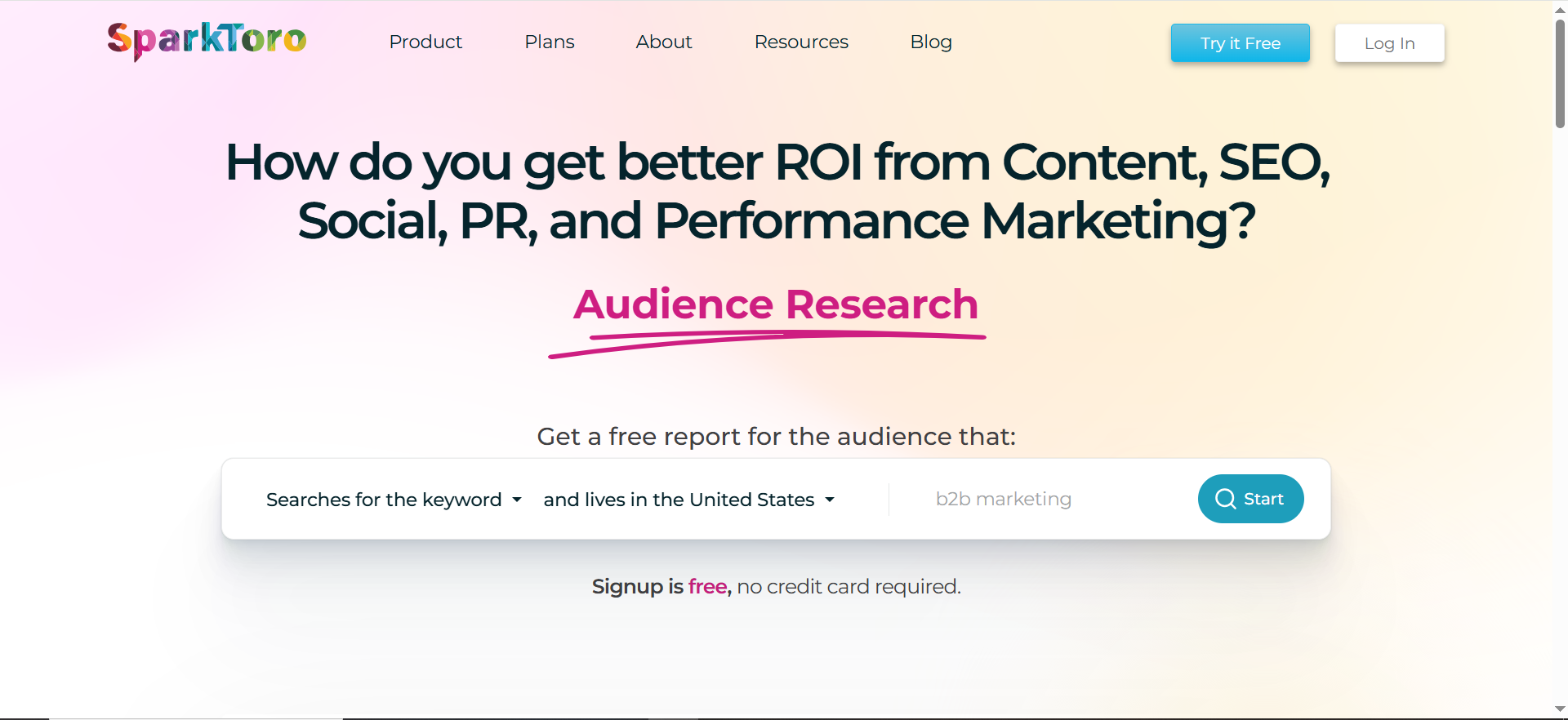

2) SparkToro (Audience + Channel Discovery)

What is it?

An audience research tool that maps where a specific audience spends attention online—the content they consume and the people they follow.

What it does?

It shows the websites, podcasts, YouTube channels, social accounts, and topics your audience engages with—so you can plan distribution, partnerships, PR, and content angles that match real interests.

Best for: Understanding where your audience hangs out so you can plan distribution and partnerships intelligently (especially helpful for promoting “best tools” and “comparison” content).

Key AI features:

- Conversational Queries: describe your audience in natural language when you’re not sure where to start.

Integrations/exports:

- Save results into lists and export (plan-based); custom imports available on some tiers.

Free tier:

- Free version/free report available (no card).

Pricing tier:

- Starter → Team (also offers one-week access, useful for short research sprints).

Strengths:

- Turns vague personas into real channel targets

- Great for promotion plans, influencer discovery, and “where to publish/pitch” decisions

Trade-offs:

- This is affinity/attention research, not a survey panel—pair with VOC tools to understand “why”

Use it like this (micro-workflow):

- Query your ICP (job title + industry + interest).

- Export top creators + sites + podcasts.

- Turn into a distribution calendar and outreach list for backlinks/mentions after you publish.

3) SurveyMonkey (Surveys + AI Analysis)

What is it?

A survey platform with AI features designed to speed up analysis—especially for open-ended responses.

What it does?

You create and send surveys to leads/customers, collect responses, and use AI to summarize results and pull themes from open text—perfect for validating messaging, objections, and buying triggers.

Best for: Running fast market research surveys and extracting themes from open-text responses—especially when you need stakeholder-friendly charts and summaries.

Key AI features:

- Analyze with AI: ask questions about results and get summaries/charts.

- Thematic analysis (beta): automatically detects themes in open-ended responses.

Integrations/exports:

- Reporting integrations like Google Sheets, Tableau, Power BI

- Exports include CSV/XLS/PPT/PDF (plan-based).

Free tier:

- Yes (start free), but AI analysis features typically require higher tiers.

Pricing tier:

- Starter → Enterprise; AI analysis is available on paid plans (Advantage/Premier/Team/Enterprise).

Strengths:

- Easy to deploy and scale

- Great for message testing and finding top objections fast

Trade-offs:

- AI insight quality depends on survey design quality

- Deep qual workflows may need a dedicated research repository tool

Use it like this (micro-workflow):

- Survey leads/customers: “What made you search for [solution]?” + “What almost stopped you?”

- Run thematic analysis.

- Turn top themes into H2s, FAQs, and objection copy on BOFU pages.

4) Ahrefs Keywords Explorer (Keyword + SERP Research)

What is it?

A keyword and SERP research tool used for SEO-driven market research—helping you understand demand and what Google is rewarding.

What it does?

It finds what people search for, estimates competitiveness, and shows what pages rank—so you can identify high-intent topics (“best”, “vs”, “alternatives”) and build a ranking-focused content plan.

Best for: Finding high-intent SEO demand (best/vs/alternatives/for-persona) and validating what Google is rewarding on the SERP.

Key AI features:

- AI-assisted search intent identification and SERP comparison to plan content aligned with ranking patterns.

Integrations/exports:

- Keyword lists and exports (plan-based), common in content ops workflows.

Free tier:

- Not full Keywords Explorer access; there’s a free on-ramp via Ahrefs Webmaster Tools for limited site tools.

Pricing tier:

- Paid SEO suite (subscription).

Strengths:

- Helps you choose winnable topics and structure pages around real SERP patterns

- Strong for bottom-funnel content clusters that drive leads

Trade-offs:

- Doesn’t provide VOC language—pair with surveys/interviews/reviews for copy that converts

Use it like this (micro-workflow):

- Pull keywords around “best ai tools for marketing research” + sub-intents.

- Group into clusters (audience tools, survey tools, VOC tools, etc.).

- Build internal linking: Roundup → category sections → tool pages → comparisons.

5) Exploding Topics (Trend Monitoring)

What is it?

A trend discovery platform that surfaces fast-growing topics early—useful for “2026 picks” updates and staying ahead of crowded SERPs.

What it does?

It helps you spot rising tools and categories before they become mainstream, then you validate those opportunities using SEO tools (Ahrefs/Semrush) and publish early.

Best for: Discovering emerging tools and categories early so you can publish before competition peaks—perfect for “2026 picks” refreshes.

Key AI features:

- Trend discovery database + tracking/alerts (more “trend intelligence” than chat-first AI).

Integrations/exports:

- Exports/alerts (plan-based). Most teams use it as a feeder into Ahrefs/Semrush for SEO validation.

Free tier:

- Yes.

Pricing tier:

- Published tiers include paid levels (e.g., Entrepreneur/Investor/Business).

Strengths:

- Great early-warning system

- Helps you find new keywords and new tool categories before competitors

Trade-offs:

- A trend isn’t automatically high-intent—validate with SERPs and ICP relevance before investing

Use it like this (micro-workflow):

- Pull trends related to AI + marketing + research.

- Shortlist those tied to buying intent (tools, platforms, software).

- Validate with Google Trends + Ahrefs → publish new sections + comparisons.

What “Best” Means in 2026 (for Marketing Research)

For this reader, “best” is not “the platform with the most features.”

The best AI tools for marketing research are the ones that:

- Use reliable data sources (your first-party data + credible external data)

- Accelerate synthesis (clustering, summarizing, theme detection, intent tagging)

- Fit your workflow (integrations, exports, collaboration, repeatability)

- Produce decision-ready outputs (insights → actions, not just charts)

If your goal is “insights that lift conversions,” this pairs naturally with CRO + Product-Led Content.

What To Evaluate Before You Buy (Fast Checklist)

Use these criteria to avoid a “dashboard graveyard” (you can also download the checklist):

- Inputs: What data does it analyze (panels, social, reviews, SERPs, calls, surveys)?

- AI outputs: Can it cluster themes, label intent, summarize, and answer follow-up questions?

- Evidence trail: Can you click into examples/quotes/posts/rows behind the insight?

- Workflow fit: Can you export into docs/slides/BI? Can your team collaborate?

- Integrations: CRM, Slack, Zapier, Notion, Google Drive, data warehouse, call-recording tools

- Governance: SSO, roles, PII handling, retention (especially for VOC and interviews)

How to Choose the Right AI Tools for Marketing Research

Start with the decision you’re trying to make, because each tool is built around different inputs (survey data, search data, your customer responses, or trend signals). If the input doesn’t match your problem, the tool won’t feel useful.

Decide What You Need Most Right Now

If you need persona and positioning clarity, pick a tool that’s strong on audience insights (like GWI Spark). If your main goal is ranking and lead capture, you need SEO demand + SERP reality (like Ahrefs). If your bottleneck is copy that converts, prioritize first-party voice-of-customer (like SurveyMonkey). If you’re doing “2026 picks” style updates, you’ll want a trend finder (like Exploding Topics). And if promotion is the issue, choose an attention-mapping tool (like SparkToro) to see where your audience actually hangs out.

Do A Quick “Fit Check” Before Buying

Make sure it fits on three levels: data fit (covers your market), workflow fit (easy to export/share), and proof fit (you can trace insights back to evidence).

Keep Your Stack Lean

Most teams can start with (SEO tool + VOC tool), then add trends or audience research only if needed.

🤙 Want the shortest path from research → revenue?

Use the checklist above, then book a call if you want us to map the leanest stack + the first workflow to implement.

Frequently Asked Questions

Only if you have high volume and multiple markets/channels where conversation scale matters. Most teams can start with lighter VOC (interviews, reviews, on-site surveys) and move up when the ROI is proven.

No. AI speeds analysis and synthesis, but it can’t replace high-quality first-party inputs. The best results come from pairing AI tools with real customer conversations and well-designed surveys.

Use Ahrefs/Semrush to match SERP intent and build winnable clusters, then use Dovetail/SurveyMonkey/Hotjar to inject real customer language into headings, FAQs, and objections.

Buying a tool before defining the decisions it should drive (positioning, pricing page changes, editorial roadmap, conversion fixes). Tools should serve decisions, not the other way around.

Wrap Up

The best AI marketing research stack isn’t the biggest stack, it’s the one that turns noise into next steps.

Start with the tools that give you the fastest leverage: SEO demand (what people are searching) + VOC (how buyers actually talk), then layer in audience, trends, or channel research when you need deeper proof or earlier opportunities.

👉 If you want a clean, repeatable workflow that turns research into rankings and leads, book a 30-minute Growth / AI Visibility Consult and grab the checklist download.